ExxonMobil Corporation is the world’s largest publicly held oil and gas company. ExxonMobil was incorporated in the State of New Jersey in 1882. ExxonMobil has three business segments: Upstream, Downstream, and Chemical. In the Upstream business, the company explores for and produces crude oil and natural gas. In the Downstream business, the company manufactures and sells different petroleum products such as gasoline, jet fuel, heating oil, diesel, and propane. In the Chemical business, the company manufactures and sells commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics, and a wide variety of specialty products.

Understanding ExxonMobil Upstream Business

ExxonMobil Upstream business includes exploration, development, production, natural gas marketing, and research activities. ExxonMobil has an active exploration or production presence in 36 countries.

Exploration. The exploration activities involve identification and evaluation of new oil and gas resources. Geologists and geophysicists search for oil and gas by studying rock samples, seismic surveys data, and a variety of other techniques. This helps them determine the size and location of possible oil and gas reservoirs. Once the company has decided to proceed ahead with the project, the development activities begin.

Development. The development activities involve drilling all the production wells and building necessary infrastructure such as platforms, processing plants, field storage, and pipelines or terminals for transportation. The drilling of oil wells over the dry land is known as onshore drilling and the drilling below the seabed is known as offshore drilling. Once the wells are “complete”, the company can start pumping out oil and gas.

Production. The production activities involve lifting of oil and gas to the surface and then gathering, treating, field processing and field storage of the oil and gas. The production function normally terminates at the outlet valve of the field storage tank.

Understanding ExxonMobil Downstream Business

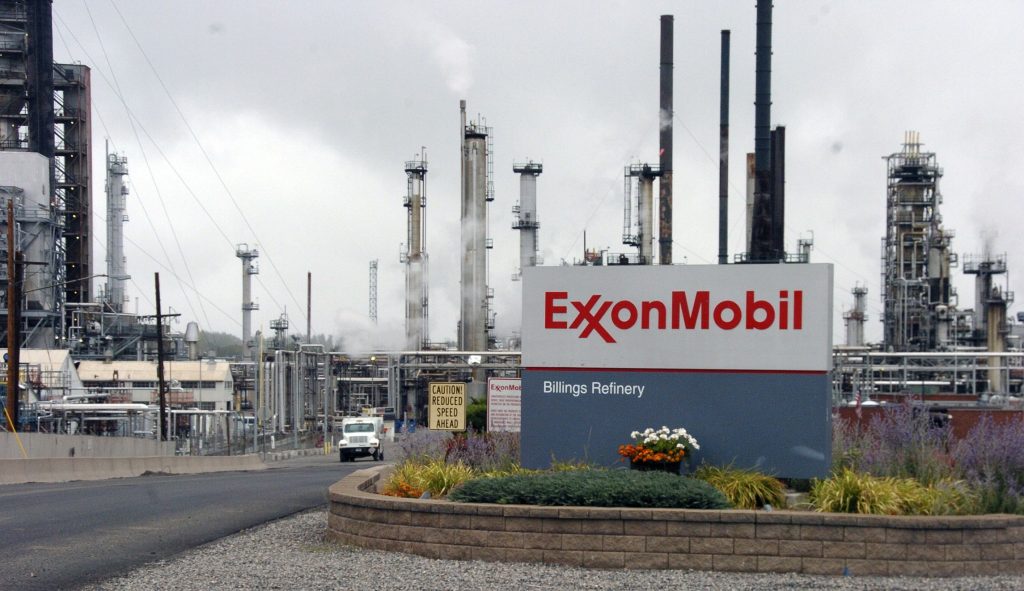

ExxonMobil Downstream business involves includes refining, marketing and selling of different petroleum products such as gasoline, jet fuel, heating oil, diesel, and propane. ExxonMobil downstream portfolio includes refining facilities in 14 countries.

Transportation. Once the crude oil has been extracted from the ground, it needs to be transported to refineries. The crude oil is delivered for processing to refineries via pipelines, ships, and railways. ExxonMobil Pipeline Company transports over 2.7 million barrels per day of crude oil, refined products, liquefied petroleum gases, natural gas liquids and chemical feedstocks through 8,000 miles of operated pipeline. Additionally, ExxonMobil has 23 distribution terminals and three salt dome storage facilities in the U.S. to manage crude oil and refined product movements.

Refining. At its simplest, refining is the process of turning crude oil into gasoline. Many complex processes are necessary to produce a full range of petroleum products such as propane and butane, diesel, jet fuel, marine fuels, heating oil, and lubricant basestocks.

Products. ExxonMobil offers a vast portfolio of consumer, commercial, industrial, aviation, marine lubricants, and basestocks and specialty products. The products are most well known and recognized in their respective segments. For example, Mobil 1 is the world’s leading synthetic motor oil brand for passenger vehicles. It provides cars with increased fuel economy and engine protection. Mobil Delvac 1 and Mobil Delvac are popular heavy-duty lubricants for commercial vehicles. They are used by fleet owner/operators to meet their engine protection and fuel economy needs. The Mobilgard brand of engine oils is the flagship product line offered to deep sea customers. It helps ship owners and operators increase vessel reliability. ExxonMobil Aviation is one the world’s largest jet fuel suppliers operating at over 600 airports.

Marketing and Selling. ExxonMobil marketing operations sell products and services throughout the world through Exxon, Esso, and Mobil brands. Esso is the leading fuel retailer. Mobil is an advanced technology in lubricants. Aviation, Chemicals, Marine, Basestocks, and Specialities market their products under ExxonMobil brand. ExxonMobil sells fuels to customers through own service stations and those owned by independent dealers. In 2015, ExxonMobil had more than 20,000 retail sites globally. In addition to the retail fuel business, ExxonMobil has a strong commercial fuels offering that serves marine, aviation, road transportation, mining, and wholesale customers around the world.

Understanding ExxonMobil Chemical Business

ExxonMobil Chemical is one of the largest chemical companies in the world. The Chemical business supplies olefins, polyolefins, aromatics, and a wide variety of other petrochemicals. Petrochemicals are the compounds derived from petroleum. Olefins are used to make packaging, plastic pipes, tires, batteries, household detergents and synthetic motor oils. Aromatics are used to make plastics, adhesives, synthetic fibers and household detergents. ExxonMobil manufactures high-quality chemical products in 16 countries.

ExxonMobil Chemical business serves the following industries: Adhesives, Agriculture, Automotive, Building & Construction, Consumer Products, Healthcare & Medical, Labels, Lubricants, Nonwovens, and Packaging. Here are few examples of ExxonMobil offering for these industries.

- ExxonMobil solves a variety of packaging industry challenges with polyethylene and polypropylene resins, propylene-based elastomers, and property modifiers.

- ExxonMobil helps automotive industry to build cars with improved mileage and lower emissions by offering premium and specialty product lines, such as butyl rubber, specialty elastomers, plasticizers, polypropylene, and polyethylene. Halobutyl polymers help tires maintain proper pressure. Specialty elastomers, such as ethylene propylene diene monomer (EPDM) rubber, are used in underhood hoses and belts as well as window and door seals.

- In the consumer goods industry, ExxonMobil resins impart strength and softness to nonwoven fabrics used in baby diapers and other hygiene items. Thermoplastic vulcanizates (TPV) and a wide range of polypropylene products improve durability and appearance in clothes washers and dryers, dishwashers, refrigerators, and small appliances.

ExxonMobil continues to develop proprietary technologies by investing in research and development. ExxonMobil held approximately 11 thousand active patents worldwide at the end of 2015.

Key Elements Of ExxonMobil Business Model

ExxonMobil business model involves the production, manufacturing, and sales of hydrocarbons and hydrocarbon-based products to consumers, businesses, and refineries. The key revenue and cost elements of ExxonMobil business model are summarized in the diagram below. It shows the different types of products offered by ExxonMobil to different customer segments. ExxonMobil recognizes the revenues from the sale of the physical products.

ExxonMobil Revenues, Profits, and Profits Margins – 2011 To 2015

ExxonMobil revenues and profit margins are significantly affected by changes in oil, gas, and petrochemical prices. A decline in oil or gas prices lowers ExxonMobil Upstream business profit margins, whereas an increase in oil and natural gas prices lowers ExxonMobil Downstream and Chemical business profit margins. On an overall basis, ExxonMobil profit margins are somewhat stable due to integrated operations and are less impacted by changes of the commodity prices in either direction.

ExxonMobil Overall Revenues and Net Profit – 2011 To 2015

ExxonMobil generated a total of $259 billion of revenues and $16 billion of net profit in 2015. ExxonMobil overall revenues and net profit declined significantly in 2015 as compared to the previous years because of a sharp decline in crude oil prices in 2015.

ExxonMobil Business Segment Revenues, Net Profits, and Net Profit Margin – 2011 To 2015

Of the total revenues of $259 billion in 2015, ExxonMobil generated

- $24 billion revenues, 9.3% of the total, from Upstream segment.

- $207 billion revenues, 79.9% of the total, from Downstream segment.

- $28 billion revenues, 10.8% of the total, from Chemical segment.

Of the total net profit of $16 billion in 2015, ExxonMobil generated

- $7 billion net profit, 44.0% of the total, from Upstream segment.

- $7 billion net profit, 40.6% of the total, from Downstream segment.

- $4 billion net profit, 27.4% of the total, from Chemical segment.

- $2 billion net loss, -11.9% of the total, from Corporate and Financing segment.

ExxonMobil had an overall net profit margin of 6.2% in 2015. It is interesting note that although Downstream operations account for most of the revenues, the net profit margin for Upstream operations are much higher. However, a sharp decline of crude oil prices in 2015 significantly impacted the ExxonMobil Upstream net profit margin as well. ExxonMobil Upstream, Downstream, and Chemical business net profit margin were 29.5%, 3.2%, and 15.7% respectively in 2015.