Did you come around financial trouble when you were least expecting it? Is your credit card maxed out and you have no instant cash flow to turn to? If this is your problem then you have come to the right place. Online installment loans are better and easier to retrieve as compared to the other types of loans and stuff. A bank probably won’t be able to facilitate you as much as you want to get facilitated that is why applying for an online installment loan is the best way to compensate for your needs.

However, if you want to increase your chances of getting this loan then you will be better off with slickcashloan.com as they offer the fastest loan approval at minimum objections and consistent but reliable packages customized to your financial situation.

Following is a brief guide taking you on a sleek journey of understanding online assessment and what their distinct features and benefits are;

What are online installment loans?

The online loans are actually the type of online assessments that can be taken on no behalf or extra paperwork nor any viable guarantee whatsoever. The borrower after taking the money can return it in regular installments. You would but have to pay for the extra interest that goes on a monthly basis thus compensating the lender institution for their time, patience, and trust in you. But then that is totally fine given that your sudden financial instability is covered by the huge sum of money that you will receive from this particular online application.

But this isn’t the only option available for you to choose when it comes to returning the borrowed amount there are other varieties of features that follow;

Ease of application

Many people wouldn’t come for the online installment loans generally because they think that either the online application process is too hectic or complicated or they presume that there is a lot of hidden terms involved. But actually, it isn’t like that, it is much simpler than you think it is. The application putting process is extremely potent and involves the relative ease at which people can get through with the application process. The approval rate is also fast and increased which means that you will get your cash in no time and without any practical delays too.

Amount

The installment debt that come online allows the borrower to easily take anywhere between $1000-3000 depending on the nature of the application and urgency that comes along with it. The range is not fixed too as you can even get larger amounts at times which means that the amount related criteria is expandable.

Fees

The most attractive selling pitch of the online installment debt is that it doesn’t involve any practical prepayment fee or a penalty if the payment gets late for any possible way. If some of the borrowers want to clear off the entire installment that they retrieved from the online installments then this can also be done too. This means that the late interest fees can be avoided which is a pretty good deal to go after.

Flexibility

When choosing an online installment loan, you can instantly get a lot of flexibility that comes along with it. For starters, you can easily negotiate the payment cycle which means that you can pay it yearly, monthly, weekly, or semi-annual payment plans. The loan that has to be paid can be relatively customized depending on the income of the borrower so a special package can be built to ascertain the borrower completely.

Detailed benefits of online installment loans

Consistent ease of repayment

Might it be also that you know already the package allows you to choose a consistent package through which you can pay the amount back. But did you know that it also allows for you to pay the amount back in several repayments until the amount is completely cleared out? And you can also clear out the whole amount in a single installment thus saving yourself a lot in terms of the interest.

Rates of the installment loan

The rate of the online installment amount is not that high as compared to the general or standard form of a loan. That is why it is important to know that the annual percentage rates on online installment loans are far less as compared to the standard loan types.

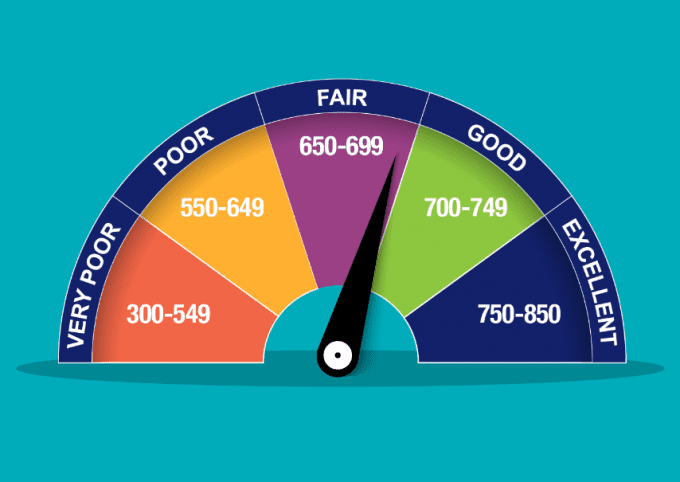

Retrieving higher credit score

For many people taking an online installment, application is all about increasing their credit score which means going for the highest possible coverage for their credit cards. But the terms and conditions for that to happen are not so optimized. You will have to stick yourself to a tight or consistent payment option that you find compatible with your current salary and living circumstances which is not an easy task to pull off. But if you come straight with such settlement then nor only you can have a higher sum of amount provided to you by the online installment agency but also your credit score can also reach a higher or upper point value.

Ease of access

If there is one single benefit that can’t be overlooked about the online installment loans then it is the benefit of having easy access to the amount. No hideous paperwork or long waiting in the queues for your turn to come up, also there are no guarantees or other prepayment fees that you have to commit to. The application doesn’t mention any particular restrictions which means that anyone and everyone can go for the amount and apply freely. This type of package should be the optimum choice of the people who earn a consistent salary meaning that they can get their hands-on other sources of money that can briefly change their lives.

It can help you to start-up small business, get ahead of the debts that wrap around you, or better yet clear your credit loan from the bank. But on the other hand, due to less and less paperwork involved it is singlehandedly the most robust loan associated with an average person earning an average salary.