Bitcoin is definitely dominant over other cryptocurrencies and there is numerous reasons for that. For now, more and more people are deciding to enter the world of cryptocurrencies, and they usually do it through Bitcoin.

However, it grows, falls and then it can grow dizzyingly again. Everything is really possible and that is why many are worried about their money. One of the most common questions they ask themselves is this. We recommend all users to be informed first before making any decision. Read more about it below.

Volatility

So, this is perhaps the most obvious reason. Why is the market so unstable and fluctuating? The price of Bitcoin is constantly changing. If we compare its value a few years ago with the current one, you will notice serious progress. For example, if you bought Bitcoin 4 years ago, it would be worth more than $ 19,000. Just a few days later, its value dropped by several thousand dollars at once, and buyers could not sell their investment for more than $ 14,000. This means that you cannot count on one value for a long time, because prices are constantly going up and down. This is characteristic of all cryptocurrencies.

Changes can take place in just a few minutes, not one day. That is why you are not brave enough to face this way of trading. In that case, you cannot be one hundred percent sure of the return on investment, but you can become safer in a simple way. If you constantly monitor the market, you can avoid bigger losses and earn a lot of money. Focus on small investments, because they will be much more useful for your future. Look at previous all-time highs, as sudden falls and rises can easily recur.

Cyber -attacks

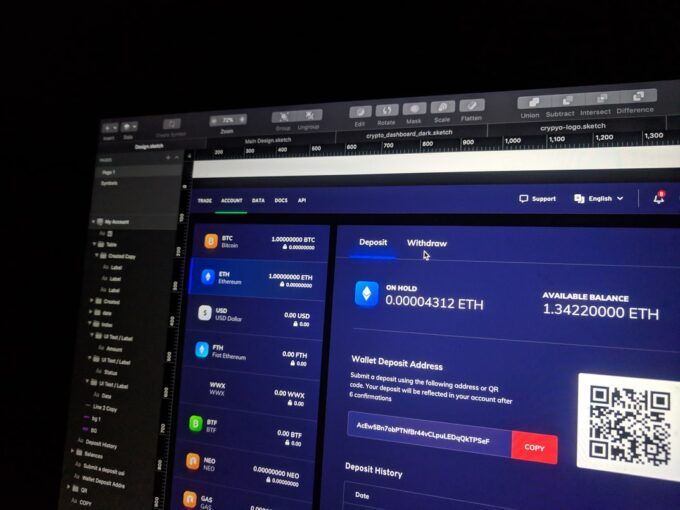

Every action we take on the digital platform is susceptible to cyber-attacks and that is nothing new. However, the higher the stake, the higher the risk. When we work with money, we don’t care about this fact, and that is why we need to always be careful. Since Bitcoin is based on technology, your investment can be targeted by cybercriminals at any time. This means that there is a real risk of hacking, which would mean that you could lose Bitcoins. For example, this can happen to you when exchanging if you have not secured your wallet enough.

You may also forget the key, etc. To prevent such occurrences, it is important to know everything about the wallet you choose. Fortunately, there are several types of wallets and you can opt for the one that offers you maximum protection. Know that the prices of wallets differ according to the levels of protection and keep your code written in a safe place. If you lose it, there is no solution that will return your wallet.

Risks with technologies

Of course, no matter how hard you try to protect yourself, leave room for potential disaster. What exactly do we mean? Most people are supporters of this way of trading, because they want to protect themselves from fiat currency, banks and other elements of the financial system. If they failed, they would have cryptocurrencies. However, consider whether they too can fail.

I can, but the chances are less. If traditional financial systems failed, remaining tangible assets such as gold in vaults would be withdrawn. When a collapse occurs that destroys technology, networks and the internet, there is no way to access Bitcoins. You just need to accept the fact that there can be a complete loss and gain.

The Use of Bitcoin

Although there has been some change and some companies accept Bitcoin as a legitimate exchange, not all companies have the same attitude. In fact, most of them are not yet ready for this step, which means that their use is somewhat limited. There are few companies, like AutoCoinCars , that support this form of currency, but there are several online stores that allow cryptocurrency exchange.

Possibility of investment

Some have seen Bitocin as an opportunity to invest in retirement and it may not be a bad idea, but there are other things you need to think about. In addition to the high efficiency of this cryptocurrency and its advantages, customers will sometimes not be paid for the action they perform. Also, don’t forget about market volatility. Lack of regulation as well as physical guarantees. Investors can really gain a lot, but they can also lose their investment.

Think about how it fits into your retirement plans or any other investments you have in mind. Take this as a great opportunity, because Bitcoin is a potentially profitable option. Of course, be careful with every investment and follow our advice when it comes to the amount of money you invest. If you take more small steps, we are sure that you will cover a lot more space and be far more confident in the outcomes.

Bitocin as a relatively new technology

We will all agree that this phenomenon is still fresh, because Bitcoin was created only a few years ago and it took time to develop into something more. A lot of changes are behind it, and we never know in which direction the market will develop. We can guess, we conclude based on current events, but with cryptocurrencies you will never be one hundred percent sure of the outcome. Maybe Bitcoin will be a totally useless cryptocurrency, and maybe the leading one. If you are constantly vigilant and focused on change, your funds will be safe, and a bright future in the market awaits you.

Conclusion

So, there are no governments or regulatory bodies that will certify the security of Bitcoins. It cannot keep its value, because it is constantly changing. Don’t forget that its value comes from trade and it is essentially invented, it is not constant. However, that is exactly the reason why you follow events and make better decisions. Everything is transparent and if you know how to manage cryptocurrencies on the market well, you will surely avoid big losses and make a profit.