1099 and W2s are tax forms that are used to deduct taxes from different types of employers. There are huge differences between both types. While the 1099 form is mainly for independent contractors, W2s are for those who receive regular payments with employee benefits. Learning the difference between these forms will reduce tax errors or the risk of potential fines. Any employee has to file annual wage reports with the Internal Revenue Service (the IRS), even self-employed independent contractors.

To steer away from common mistakes and misunderstandings, this article will further explore the main differences between both forms.

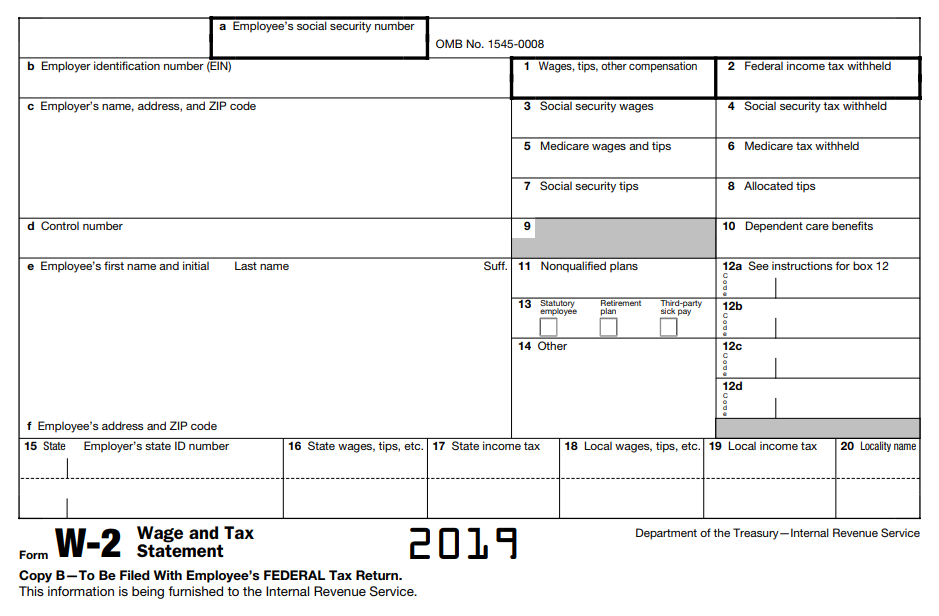

W2 forms

As a business owner, to be safe from this misunderstanding, you have to first determine who works for your company and who doesn’t. Misclassifying employees might put you at risk of filing suit against you or your business. For example, any wrongly categorized W2 employee who was mistaken for an independent contractor can sue you for missing the health benefits, fixed payments, and the minimum wage that has been set by both state and federal laws. Employees who should receive the W2 form are the ones receiving regular payments every month and benefits. Any individual who is performing services under your control is considered to be an employee and should be issued a W2 form. They are used to report wages, tips, and other paid compensations. Other than monthly payments, these forms should include withholding information to be reported to the SSA.

1099 forms

1099-MISC forms, on the other hand, need to be issued to independent contractors, but only if you have paid them more than $600 during the tax year. Workers such as consultants, independent professionals, just like accountants or attorneys, or trade workers aren’t considered as employees and should receive a 1099 form. While W2 employees should include social security and Medicare income information, the 1099 form doesn’t have this section of information. The 1099-MISC form specifically is for an LLC or individuals, unlike other types of 1099 forms that are more for corporations. Information found at FormPros.com claims that business owners need to make sure they get all the needed help to avoid many common mistakes and errors that might cost a lot. The 1099-MISC form should include the total payment you have made out for the worker. Sometimes it’s required to also include a backup withholding.

Educating yourself on the different required forms will save you a lot of trouble you could easily get into due to commonly make mistakes. Even though both W2 and 1099 are tax forms, they differ in the information you have to provide and the types of employees who receive them. While the 1099-MISC form is for independent contractors who are usually self-employed but they provided a service for your business, you don’t have to send them the form if you paid them less than $600 during the tax year. If you are not sure under which category your employee falls, you can always look at the benefits they receive and determine whether they are employed or independent contractors.