Think of your startup as a child. You need to take care of it. You need to pay for its needs, health, education, security, and protection. You need to invest in the growth and future of your startup. All these expenses require money; therefore, financing is essential for startups. Capital helps startups convert their ideas into real projects that can make a difference. There are many different ways to finance a startup, but the most popular ones are self-funding, getting an external investor, or getting a business loan.

One of the biggest obstacles every startup has to face is raising finances. Provided that each and every business needs sufficient amounts of capital not only to initiate a particular business but also to keep it running, they tend to approach means of financing.

Securing the finances can be tough and challenging. This is due to the multiple decision-making and dealing with third-party authorities. This article will guide the startups over different means and modes of financing which can be adopted in order to raise capital successfully. Take a look at the several ways to obtain financing for your new business:

1. Bootstrap

This is the most convenient form of funding for a startup. It is also termed self-funding. Without having a solid business plan which guarantees success, it is difficult to get financing from other means. Therefore, startups in such an event can invest in the business from their own personal expenses and savings, obtain some funds from friends and family and contact personal acquaintances. It also entails cutting down on the major expenses which the business may incur. It is a beneficial form of financing since there is no need to comply with external formalities.

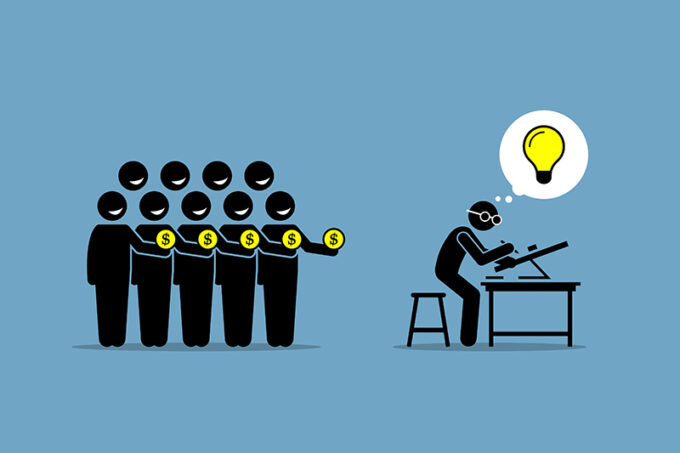

2. Crowdfunding

Crowdfunding is a relatively newer form of finance that startups can look forward to. It has gained popularity these days. It means that the business can acquire debt, equity or contribution from different sources. The business may show the detailed plans on the platform which will be accompanied by profit projections. Since the business plans, products and services are shown to the crowd at large, it will even work as an effective form of marketing along with the scheme of financing.

3. Angel investments

Some individuals invest in startups by providing seed funding. These investments are normally made by investors called ‘angel investors’. The said investors have cash in surplus which they may be eager to invest in somewhere. There might also be a group of investors who are evaluating different proposals to invest into. Such angel investors include renowned companies such as Yahoo and Google. If a business is short on capital, then this may be an effective form of investment to acquire. However, it is pertinent to note, that angel investors do not invest it completely into the business.

Keep in mind that there are pros and cons in obtaining funds from angel investors. One of the best advantages of using angel investors is that they are less risky than taking out a business loan. However, there are always trade-offs in every type of business financing. While angel investors may not seek monetary returns, they’ll likely demand equity in exchange for their investment.

4. Bank loans

This is normally the first thing that comes to mind when it is about money, loans, and financing. Banks are usually willing to provide financing for businesses. These may either be secured loans or unsecured loans. Furthermore, you may also receive funding loans in which the business will be required to share the plans, valuation, and other details of the business vehicle under which the startup will run. Provided that there are multiple banks in the market such as Ikano, make your choice accordingly.

If a startup struggles to make ends meet, entrepreneurs should look for other ways to fund their business venture. Suppliers like workspan.com offer guidance and technology to launch co-investment programs and other funding models.

5. Venture capitals

Venture capitalists are stepping up their game and using the power of their positions to invest in startups that they think may have the potential to succeed. Although it is really difficult to get investments from venture capital companies, these investments are normally the most lucrative of all. These are businesses that manage funds and such funds are invested in potentially successful startups.

Equity injection is made in the business and as soon as there is an IPO or acquisition, the venture capital firm makes an exit. Such firms provide mentorship along with financing. As mentioned above, it is difficult to get investments from venture capital firms given that they are looking for startups that already have a stronger team and stability in the market.

6. Business incubators

Incubator programs can be approached for financing at the early stages of the business. Such programs assist hundreds of businesses on an annual basis. These programs do not only provide financing but also mentorship in terms of training and tools. They even provide a developed network where the business can be conducted. The training period is normally short, not lasting more than a year, in which the startups can make good connections with the investors. With the passage of time, the trend of business incubator programs is increasing.

7. Contest winnings

This is a much-undermined mode of raising finance for your business. Entrepreneurs are encouraged by business contests to come up with creative and innovative business ideas. In these competitions, the business has to either come with executable business plans or manufacture products which have the potential of selling. Winning the contests can also potentially make the business famous. There are some success stories of businesses that have obtained financing from just winning the contests.

8. Non-banking finance companies

NBFCs are finance companies but do not belong to the banking sector. Investments can be acquired through such organizations. However, these organizations work in a similar manner to a bank. They provide loans and other banking services. These lenders will have their own requirements in terms of the interest rates and the period of the loan. Before accessing such loans, it is recommendable for businesses to evaluate the terms and conditions to determine whether the same is favorable or not.

9. Government programs

This is perhaps the most untapped resource in this day and age. Although this depends from the government to government, programs funded by the government can be accessed for better financing. Governments all across the globe normally launch funds for new startups to encourage business in the nation. All that the business has to do is submit a business plan with all the details in it. Thereafter, the financing is granted. However, these forms of financing are not sufficient if a huge amount of capital is needed. It may be sufficient for small-scale startups requiring lesser capital.

10. Other methods

There are several other methods through which financing can be raised. Nevertheless, these methods are only designed for few businesses which require a nominal amount of money. For example, credit cards can be used to finance a startup. Moreover, the potential products can be sold before they are even launched in the market. It is an effective method to raise financing. Furthermore, assets can be either sold or mortgaged if you want to get immediate capital; but however, it is a volatile and risky form of funding.

More useful details, you can find at pdq-funding.co.uk.