There are certain universal truths about having a good financial life. Among them is the idea that you should not spend more than you earn, or that you should make an effort to pay down debt, or that you should not buy things that are way over your budget. But there is one more kernel of truth that would need to be added to that list: do what you need to do to have your credit score be as high as possible.

Why are good credit scores such an important part of a solid financial life?

Having a good credit rating is the equivalent of having a magic key that is able to unlock many benefits and savings. These are access to credit cards, loans, and lines of credit with the most favorable terms. And if you are not at the moment hunting for the best loan or credit card, a good credit score might also, in some cases, impact your ability to land a job. You can check your credit score for free with ClearScore.

Other benefits associated with a high score are the fact that you may qualify for lower insurance premiums on car insurance or that a landlord or rental management company will look at your score to determine whether you are a financially trustworthy individual.

Do you know the numbers associated with a high credit score?

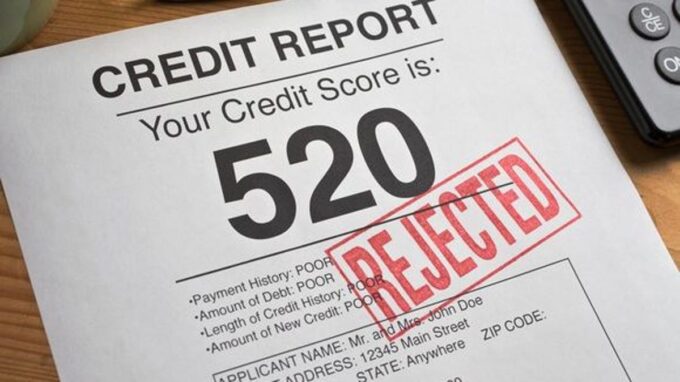

The FICO score, on which credit ratings are based, ranges between 300 and 850. And this is how those numbers are broken down:

- A poor score would be up to 579

- A good score ranges between 670 and 739

- A very good score goes from 740 to 799

- An exceptional score stands at 800 and above

Most lenders consider scores above 700 to be good credit scores.

If your score is low, is there anything you can do to improve it?

There is no instant formula that can be applied to a low credit score to make it great in an instant. It might not come as a big surprise to you that the steps you need to take to improve your credit score are precisely the opposite of what you have done so far.

If you are ready to start rebuilding your credit score you should know that there are seven items that are combined when it comes to determining them. Here they are:

Your Payment History

This is by far one of the most important elements used in setting someone’s credit score. It adds up to 30 or 35 percent of the score. What is considered here are late or missing payments. You can boost your score by making it a point to pay your bills on time every month. If you are consistent you will see a higher score over time.

Your Credit Utilization Ratio

While you have a certain amount of credit available based on the limits established by the issuers of your credit cards, this item looks at the amount of revolving credit you are actually actively using. If this ratio is low, your credit score will be higher. Ideally, you should aim to keep it below 30% but for the best scores, aim for 10% or less.

The Number of Accounts You Have

How many credit cards do you have? Do you use them all? Do you carry balances? Try to have more accounts that do not have a balance than those that do.

Your Credit History

This refers to how long you have used credit actively. A long credit history does wonders for your credit score. In this case, there is nothing for you to do but let time go by.

Your Credit Mix

This point refers to the type of credit you have, whether it is only credit cards or a mix of credit cards and installment loans. A good credit score reflects a good mix of different types of credit.

Any Negative Credit Information

If you have filed for bankruptcy, have had a property foreclosed upon, have had a car repossessed, or have a collection account, your credit score will be negatively affected by this.

Hard Inquiries

When a lender requests to see the information on your credit report, maybe because you are applying for a new credit card or to get any other type of loan, this is called a “hard inquiry”. If you are shopping around for a new car, for example, there may be several inquires during a short time period. However, they are treated as if they were just one. Hard inquiries lose their impact on your score the older they get.

Should you work with a credit repair company?

If you need a boost to your credit score, working with a credit repair company such as My Credit Repair Clinic may give you the leg up you are looking for. Although you can certainly approach each one of the credit bureaus on your own and file formal disputes with them, you may not be successful in presenting a strong case.

Let’s say you have a collection account. Without you knowing about it, it has been sold to a few debt collectors. This may have this account appearing several times on your credit report. Although the information is accurate, the fact that it appears so many times may affect your score if it is taken as multiple collection accounts. It is at times like these that relying on a credit repair service may make the difference you are looking for.

Understanding your credit score, what elements go into it, and what steps you can take to improve it, may place you on the right path to realizing your goals. Whether you are looking into buying a home, getting a new car, or purchasing an expensive item, a good credit score will help you achieve these goals.

And even if at the moment you have no plans to make any major purchases, keeping your credit score at a high level is almost like buying purchasing insurance for the future. Don’t throw away your financial lifeline just because at the moment you see no utility for a high credit score.