There is a special kind of Mutual Fund, called a Liquid Fund, which many investors prefer to have in their kitty. This type of fund allocates all of its assets into short duration low-risk investments like commercial papers, treasury bills, certificates of deposit, bank fixed deposits and other short term money market instruments. Some of the best liquid funds bogartwealth.com have assets under management in excess of Rs. 70,000 Crores, which speaks for itself. These short term liquid funds have a maturity of 91 days.

The process of NAV(Net Asset Value) calculation is unique. The NAV for a normal mutual fund is calculated for business days or market days, whereas the NAV of a liquid fund is calculated for 365 days.

Liquid Funds Vs Bank Savings A/C: which one to prefer?

Both of these investment options offer high liquidity. The returns from liquid funds are quite high when compared to a bank savings a/c, which only gives around 3-4% p.a. Liquid funds can easily give around 6-7% per annum, assuming you have selected the best liquid funds in the market. Considering the returns, it is safe to say that parking your money for a short while in the best liquid funds would be more beneficial.

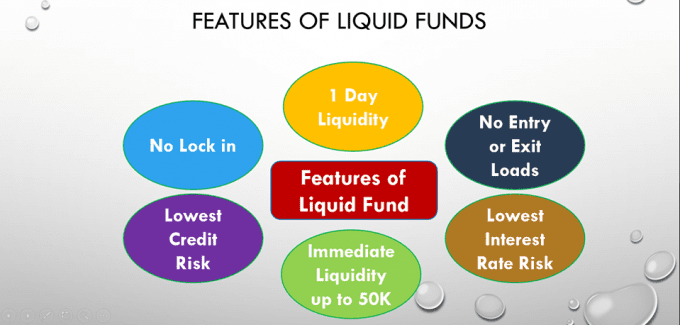

However, although most liquid funds offer instant withdrawal, it might take up to 24hrs for the money to reflect in your bank account.

Taxations on Liquid Funds

Like other Mutual Funds, liquid funds are also subject to both the Short Term Capital Gains(STCG) Tax and Long Term Capital Gains(LTCG) Tax. If you withdraw the money before 36months, an STCG tax would be applicable. For withdrawal after 36 months, and LTCG tax with indexation(adjusted for inflation) would be applicable.

For people who opt for the dividend payout option, there would be a Dividend Distribution Tax(DDT) applicable.

Advantages

Other than the ones stated above, there are a few added advantages:

- Low Expense Ratio: Expense Ratio is the fee charged by the AMC/Fund Manager for maintaining the fund and its assets. A reasonable expense ratio for an actively managed fund depends on the category average expense ratio. Liquid funds have a low expense ratio compared to other debt funds. A maximum of 2.25% expense ratio can be levied for these funds by an AMC.

- No Entry/Exit Load: Most mutual funds have an entry or exit load attached to them which are charges deducted on investment and withdrawal respectively. Liquid funds have no such charges or loads.

- Very Low Risk: As the asset allocation is done towards short term money market instruments like government treasury bills, commercial papers, certificates of deposits, bank fixed deposits, etc., the risk associated is very low. The NAV can still falter for liquid funds if any of the assets go for a severe downturn.

Now that you have a basic idea about the features and benefits associated with a liquid fund, we would like to help you choose the best liquid funds in the market right now. So here is a curated list of the five top-performing liquid funds from Scripbox:

1. Axis Liquid Fund Growth

Launched on 10th September 2009, this fund has shown exemplary performance and growth over the years. It has a very low expense ratio of 0.18% with AUM of Rs. 30,980 Crores. One-year returns are around 6.17%, 3Year returns around 22%, which is higher than the category average. This fund is managed by Mr. Devang Shah who has over 10 years of experience as a fund manager.

2. Tata Liquid Fund Regular Growth

This fund has been around for a long time, growing steadily over the years. It also has a low expense ratio of 0.33%, having assets under management of Rs. 9429.5 Crores. One-year returns are good at around 6.17%, which is also higher than the category average.

3. Aditya Birla Sun Life Liquid Fund Growth

Showing steady growth, this fund has given historical returns of 6.19% (in the last year) and 21.9%(in the last 3 years). Its expense ratio is 0.3 and has assets under management of Rs. 41,465 Crores.

4. L&T Liquid Fund Growth

Performing well over the years, it has given returns of 6.07%(One-year) and 21.78%(last 3 years). It has an expense ratio of 0.15 and assets under management of Rs. 6,098 Crores. This fund is managed by Mr. Shiram Ramanath (CFA, MBA-XLRI), who has 23 years of experience in the financial sector.

5. Nippon India Liquid Fund Growth

Previously called Reliance India Liquid Fund, this fund has been a steady performer as well. Historical returns are at 21.7% for three years and at 6.17% for one year. It has an expense ratio of 0.27, with assets under management of Rs. 28,266 Crores. This fund is managed by Ms. Anju Chajjer, who has 24 years of work experience in the financial sector.

These liquid funds are considered the best by us because they have shown consistency in their performance and returns. Also, the high AUM of the funds only validates our selection. Still, as an individual investor, you should always be wary of the market conditions and choose the best liquid funds as per your requirement and financial goals.