How Long to Pay off Loan [+5 Tips to Do It Faster]

Loan repayment may be an exhausting process for your budget. It temporarily bounds you from your usual lifestyle, and makes changes in cash management. Everybody knows how important it is to choose convenient conditions and adapt to them.

However, some borrowers miss such factors as terms of repayment. These numbers are essential for understanding how much you’re going to pay in total and vary from one type to another. Express loans offer quick deals, while mortgage stretches to decades.

See the main types of credit duration, and special tips on accelerating this process.

Repayment on Schedule: How Long Would It Take

The loan duration is always given in the lender-borrower agreement. The payments are divided along this period and represent a fixed sum you should give each month. Depending on the type of credit and your lender, this factor may significantly differ:

| Credit type | Average duration |

| Mortgage | 15-30 years |

| Installment | 12-96 months |

| Auto | 12-96 months |

| Personal | 6-72 months |

| Payday | 14 days – 1 month |

With this information, you can quickly count the sum of interest you will pay over these years. Use percentage calculators: enter the sum you borrow, interest rate, and the duration. It helps to define which terms are the most suitable and affordable for your case, and avoid overpaying.

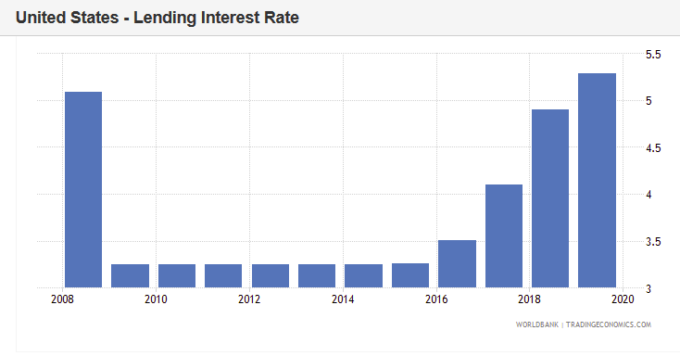

If you feel comfortable with the conditions, paying on time is the perfect variant for you. Don’t forget about your schedule, and gradually clear the debt. However, most people think about easier ways – the interest rate is rising year to year, and those who take loans in 2024 seek ways to economize on the rate.

So-called early repayment is a quick way to save money and time – let’s dive into it.

How Loan Prepayment Works

An early repayment is an act of repaying the debt earlier than it’s mentioned in the agreement. Such an approach may be used to save either time and money, freeing yourself from the rates.

Marc Eisenson, an author of “the Banker’s secret”, imagined a typical situation: a 100 000$ 30-year mortgage with 8% interest. Paying on schedule, the buyer would give more than 700$ interest monthly.

He also calculated that by prepaying 50$ each month, the borrower economizes 39,906 dollars in total. Marc says:

“A prepayment of just $50 is added to the first mortgage payment, that $50 is deducted from the principal balance remaining on the loan… The borrower never pays a penny of interest on that $50.00 – not for the next month, not for the next year, and not for the next 30 years.”

Here’s where a common misconception appears – people think, they economize only time, while early repayment is also a matter of interest you avoid over the years.

When Do You Need It?#1 Prepayment Is Allowed in the AgreementNot every lender allows you to pay earlier. It seems nonsense – every bank would like to receive its money back, isn’t it? Well, things aren’t so clear. Permitting you to repay earlier, banks lose a part of interest. That’s why some lenders provide fines and fees for such procedures. It’s simply disadvantageous, and the bank would do everything possible to prevent you from the repayment. #2 You Have a Free SumThere’s no sense in giving all of your capital for the debt, especially if you are fine with the conditions. Reconsider your savings before making a decision. Do you have a free sum you won’t need in the nearest future? Don’t hurry with the repayment. Sometimes having an emergency fund is more important than clearing your credit history. #3 Conditions Daily Bound Your LifeSome loans are very, very cumbersome. If you feel that the present situation is too bearing for your mindset and budget, direct all your forces to solve it. |

How to Repay Your Debt Faster

If your agreement allows you to pay earlier, why not use this opportunity? Here are 5 ways to collect enough money as soon as possible.

#1 Loans for Consolidation

This option suits people with inconvenient conditions and extremely high rates. If you suffer from the present debt, find a replacement. Consolidation credits were made to clear your previous debts, and return this sum with more beneficial conditions. Before deciding on such a step, make sure you’ll be able to get the job done.

#2 Budgeting

Start controlling your finances, and try to make savings each month. Tracking expenses, you’ll see how much cash can be saved for your purpose.

For this, learn the basics of financial literacy. A simple plan of expenses can help you to define all cash flows and make the best out of your opportunities.

#3 Find a Part-Time Job

If the matter is necessary and you cannot afford to overpay so much, take measures to collect the required sum. Working on the weekend, or making some jobs online, you’ll be able to earn a small sum each month.

Such a method won’t help you to clear the debt at once, but small prepayments are also a good alternative.

#4 Borrow From Friends and Family

Such deals don’t imply rates, and sometimes even free you from deadlines. However, be careful and forecast your opportunities before. Being owe to close people is a big responsibility, affordable only in critical situations.

#5 Get Rid of Impulsive Purchases

That’s how our brain works – we prefer small joys here and now, and rarely analyze their impact on large aspects of life. Be sure that coffee to go doesn’t have a bad credit history and overpaying at the bank. Learn to control yourself and put all efforts to collect as much money as possible.

Loan duration varies depending on the credit type, the sum you borrow, the lender, and other factors. You can easily count the amount of time and percentage you are going to pay over this period. However, some deals allow you to repay the debt faster and economize this way.

Before cutting the deal, thoroughly check the papers and discover whether you can clear the account earlier than it was planned and whether it implies any additional fees.