At the height of the coronavirus-induced meltdown, the financial market experienced an enormous influx of new investors. After years of sitting on the sidelines, young people ventured into the world of stocks and took advantage of the massive discounts, from cruise lines to bankrupt retailers to memeified tickers.

The decision paid off immensely, with the entire market trading at all-time highs. Now that the ultra-bull run has cooled down, investment decisions will need to be based on due diligence, technical analysis, and keeping a close eye upon market trends and developments.

At the same time, other considerations need to be made before choosing what stocks to buy, how much to invest, which accounts to utilize, and a myriad of other factors that need to be taken into account. Investing goes beyond hitting the buy button, waiting for a 1,000 percent return on an investment, and then hitting the sell button.

Dollar-cost averaging (DCA), reading analysts’ opinions, and paying attention to the news…these are only a few of the many things that smart investors practice before buying stocks, mutual funds, ETFs, REITs, and all the other products available on the market today. Capital, risk tolerance, and investment accounts are the primary elements to explore.

We have compiled a beginners guide on what to consider before making investment decisions:

1. Can You Afford to Invest?

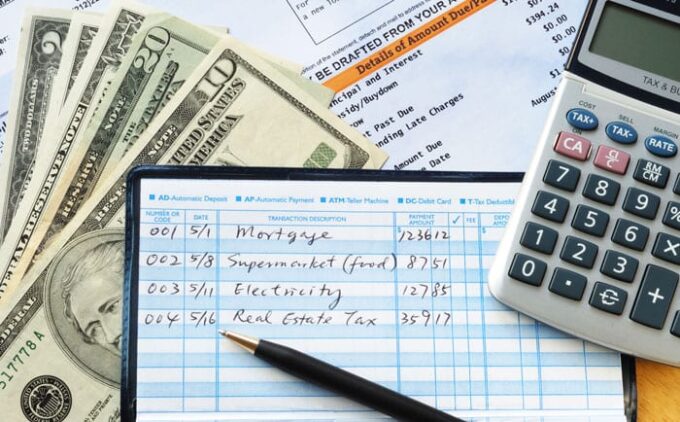

Are you living paycheck to paycheck? Are you drowning in debt? Are you precariously employed? Suffice it to say, money is tight these days. It can be hard to keep your head above water, particularly as the cost of living intensifies and wages fail to keep up with price inflation.

There are certain cases where you cannot afford to invest. You need to hang onto every dollar to ensure you have a roof over your head, food on the table, and clothes on your back. Until your budget comes under less pressure, you may need to wait until you buy shares in Tesla Motors or the next initial public offering (IPO).

2. What is Your Risk Tolerance?

When you start an investment account at your financial institution of choice, you are usually asked what your risk tolerance level is, such as your comfort level if the stock market drops five percent, or if you would sell an investment if it appreciates five percent. Indeed, investing is not for the faint of heart.

Of course, everyone possesses a unique tolerance for risk. Some investors are content if a stock plunges 35 percent because they are in it for the long haul. Other investors want to take any little profit and run. What about you? This is important to determine before you buy shares in Microsoft or a real estate investment trust (REIT).

3. How Savvy Are You as an Investor?

There is nothing wrong with knowing very little about finance and still playing the markets. It is a complex world filled with numbers, jargon, and analyses. If you were to rate yourself on a scale of 1 to 10 when it comes to knowledge about investing, what number would you give yourself?

The average person knows what buying and selling means. But what about the more intricate aspects, like reverse stock splits, P/E ratios, earnings per share (EPS), or exchange-traded funds (ETFs)?

These should not be barriers to entry, but your financial acumen can indicate how much you should be investing on the New York Stock Exchange or what vehicle you use to invest.

4. Where Are You Investing Your Money?

The finance sector has evolved greatly over the past decade, ushering in a treasure trove of ways to invest and save your capital. From mobile application trading platforms to all-in-one checking and investment account Finch, you are not confined to a middleman firm that eats a chunk of your profits through fees.

There is also a generational divide, with older investors using conventional trading platforms and newer investors turning to zero-commission and mobile-trading platforms. That being said, your age shouldn’t impact how you invest! Explore your options, and make a decision based on which platform fits with your goals and comfort level.

5. Are You in the Market for the Long Haul?

The appeal of lottery stocks – AMC, GameStop, Nokia, and BlackBerry – might turn novice investors into day traders; a recipe for disaster. The Warren Buffett strategy consists of buying and holding stocks for the long-term, which is proven to work.

But this only works if you are investing money you can part with – or potentially lose – for several years. You need to determine if you are investing for the long haul or planning to buy and sell at certain price points.

6. Roth IRA or Traditional IRA?

Individual retirement accounts (IRAs) are essential for retirement investing. But there are two types of IRAs: Roth and traditional.

A Roth IRA consists of contributing after-tax dollars and allowing your money to grow and be withdrawn tax- and penalty-free after age 59 ½. A traditional IRA includes contributing pre- or after-tax dollars, meaning that your taxes will be deterred, and withdrawals will be taxed as current income after you turn 59 ½.

7. How Are Your Overall Finances?

From relying on credit cards to pay the rent, to spending $5 every morning on lattes, not everyone has the most impressive financial management skills. This has triggered poor pecuniary conditions for millions of households across the United States and the rest of the world.

Even folks who do not need to buy the latest iPhone can struggle due to circumstances beyond their control, such as inflation or taxation. Before most of your investing decisions, you need to consider the state of your dollars and cents.

Don’t be afraid to start small. Even the smallest changes to your money spending and management habits can go a long way over time, helping you on the path to getting your money to work harder for you.