Ever heard of the term “halving” in the Bitcoin realm? It’s a climactic event for Bitcoin miners and the entire crypto community, marking a significant reduction in the rewards miners receive.

As it stands in 2024, the bounty for validating transactions and mining a block is set at 6.25 bitcoins (BTC). However, Bitcoin’s next halving slated for 2024 threatens to slash this reward down to 3.125 Bitcoin.

Before we delve into the intricacies of halving, let’s lay some groundwork by discussing the Bitcoin network.

Bitcoin Network

Picture an extensive network of computers, otherwise known as nodes, each holding a complete or partial history of all Bitcoin transactions.

Full nodes, which contain the entire transaction history, act like gatekeepers, giving thumbs up or thumbs down to each transaction based on a series of checks. Once all transactions within a block are approved, they’re added to the Bitcoin ledger, and the information is broadcast to other nodes.

The more nodes there are, the more secure the blockchain is. As of the beginning of April 2024, there were approximately 17,309 nodes running Bitcoin’s code.

Bitcoin Miners

Bitcoin miners are the transaction processors and validators of the Bitcoin network. Using either regular computers or specialized mining hardware, they solve complex mathematical problems in a process known as Proof-of-Work (PoW).

The term “mining” is a tip of the hat to the arduous process of extracting precious metals from the earth. Once a block is filled to the brim with transactions, it’s ready for mining. Miners then compete to solve a complex mathematical problem first. The victor gets to add the block to the blockchain and is rewarded significantly for their efforts.

Bitcoin Halving

So, where does halving fit into all of this? Every 210,000 mined blocks – a milestone reached approximately every four years – the miner rewards are slashed in half. This mechanism slows the rate at which new Bitcoins are created and released into the market.

It’s projected that by 2140, all 21 million Bitcoins will have been mined. After that, miners will earn their bread and butter through transaction fees paid by network users.

Bitcoin Price Predictions

Unpredictability is the only certainty when it comes to predicting Bitcoin’s price post-halving. Sure, some investors follow the patterns etched by previous halvings, hoping history repeats itself.

The patterns painted by historical data suggest that the halving could trigger significant shifts in BTC’s price, as was the case in previous halvings. However, global economic conditions, regulatory changes, and the strategies of institutional investors can sway the outcome.

For instance, in the 2012 halving, Bitcoin’s price skyrocketed from about $11 in November 2012 to approximately $1,100 in November 2013, marking a dramatic increase within a year.

In 2016, Bitcoin’s price escalated from around $650 in July 2016 to nearly $20,000 in December 2017. The market sentiment during this period was overwhelmingly bullish, driven by increased mainstream media coverage, a surge in initial coin offerings (ICOs), and the arrival of institutional investors.

However, regulatory changes, such as crackdowns on ICOs and attempts to impose stricter rules on crypto exchanges, introduced an element of uncertainty and contributed to market volatility.

The 2020 halving event saw Bitcoin’s price grow from about $9,000 in May 2020 to an all-time high of roughly $69,000 in November 2021. This halving was marked by increased institutional interest, with major corporations and investment funds making their debut in the crypto market.

The COVID-19 pandemic also played a significant role in shaping market sentiment. As the global economic downturn and unparalleled fiscal stimulus measures stoked fears about inflation and currency debasement, demand for Bitcoin as a digital store of value surged.

Institutional investors, in particular, have a significant influence over the market. Their response to the halving event can substantially impact Bitcoin’s price and the broader cryptocurrency market.

For example, during the 2020 halving, the growing interest of institutional investors in Bitcoin as a hedge against inflation and macroeconomic uncertainties played a key role in its price surge.

Despite historical data, it is worth noting that the future price of Bitcoin after subsequent halvings heavily depends on how demand develops during the halving period.

History of Bitcoin Halving

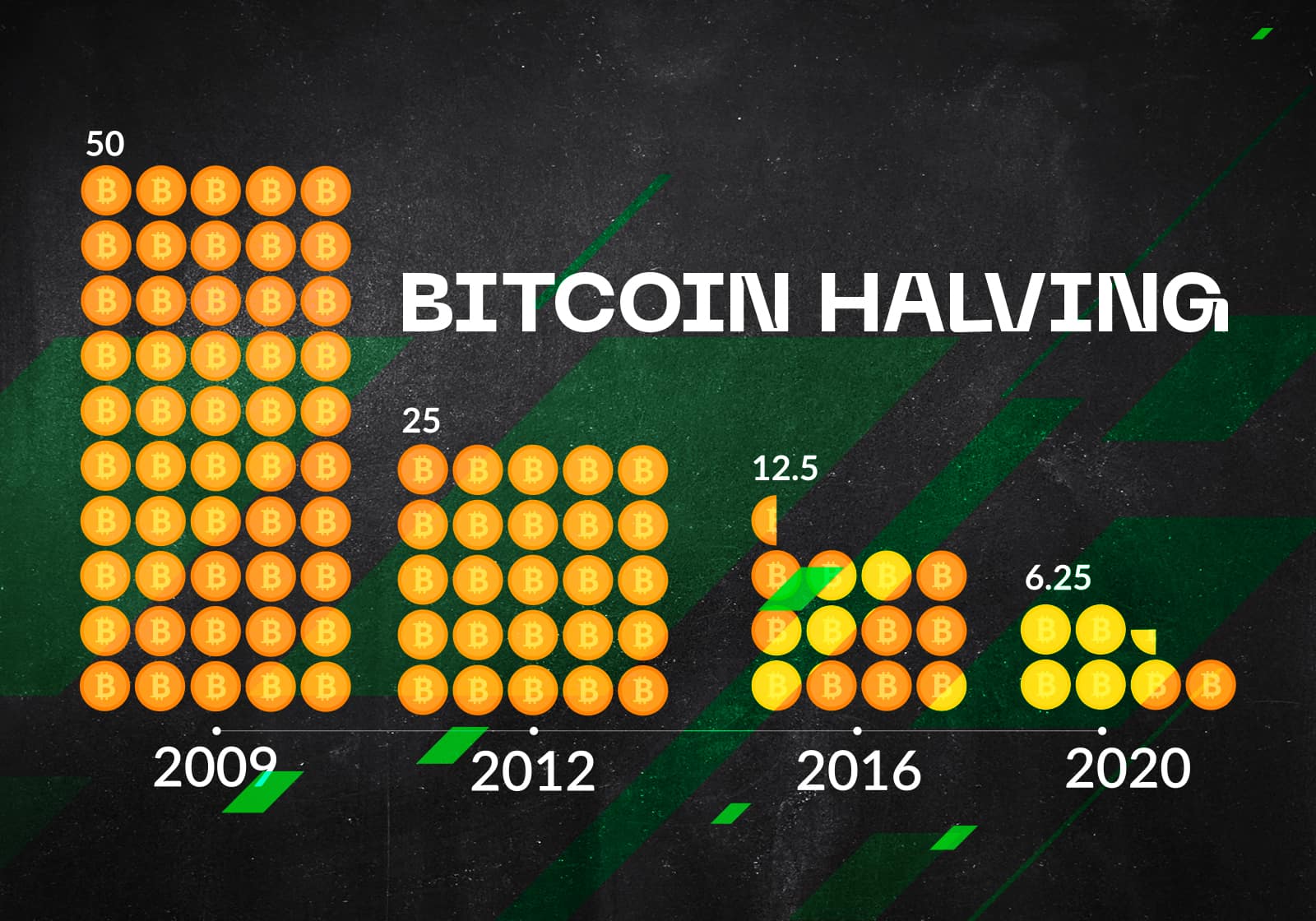

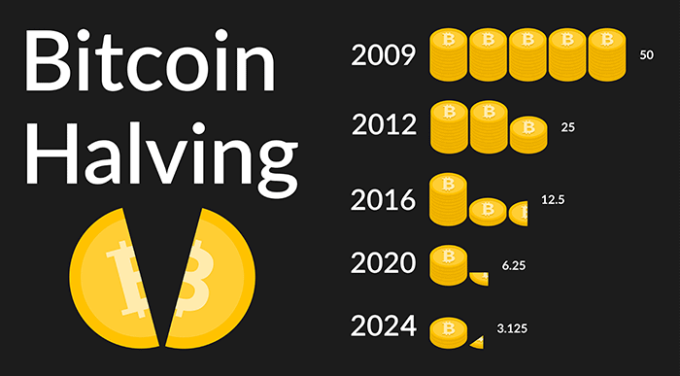

The halving phenomenon has quite a fascinating track record. Back in 2009, miners received a whopping 50 Bitcoin for every block mined. Come April 2024, approximately 19.3 million Bitcoin are circulating in the market, leaving only about 1.68 million more to be released through mining rewards.

Until today, the halving events have occurred three times:

- The first halving took place on November 28th, 2012, reducing the block reward to 25 Bitcoin.

- The second event happened on July 9th, 2016, further diminishing the reward to 12.5 Bitcoin.

- The most recent halving, on May 11th, 2020, brought the reward down to 6.25 Bitcoin.

You might be wondering why these halvings aren’t happening precisely four years apart. The reason lies in the Bitcoin mining algorithm, which is designed to mine new blocks every 10 minutes. However, this duration can fluctuate, thereby affecting the timing of the next halving.

Impact on the Crypto Industry

Bitcoin’s impending halving is not just a Bitcoin event – its shockwaves are expected to shake the entire crypto market.

With the lowered mining rewards, the crypto community, including investors, miners, and users, might shift their focus to altcoins that promise superior mining rewards, efficient consensus mechanisms, or distinctive values that meet particular use cases or industries.

This pivot could fuel an increased interest and subsequent adoption of altcoins, altering their prices, market capitalization, and overall relevance in the crypto-verse.

Investors, for instance, could diversify their portfolios with cryptos that are less prone to the effects of halving events. Prime examples are cryptos using Proof of Stake (PoS) consensus mechanisms that don’t hinge on mining for network security and token distribution.

Moreover, the halving event could serve as a spark for technological innovation in the blockchain sector. It might stimulate developers and researchers to discover novel ways to boost mining efficiency, cut back on energy consumption, and enhance transaction processing prowess.

These innovations might pave the way for new consensus mechanisms, Layer-2 scaling solutions, and blockchain architectures that tackle the current restrictions of existing networks, Bitcoin included.

Not only that, but the halving event could also trigger a reassessment of the prevailing market dynamics. It could throw a spotlight on the long-term viability of Proof-of-Work (PoW) networks and the environmental impact of mining operations. This scrutiny could push the industry towards adopting greener and more efficient technologies and foster the development of innovative solutions that balance decentralization, security, and environmental considerations.

The halving could also influence regulatory advancements in the crypto space. As it draws the attention of investors, governments, and financial institutions, it might instigate discussions about the suitable regulatory framework for cryptocurrencies and the necessity for clearer guidelines to ensure market stability, investor safety, and compliance with existing financial regulations.

Conclusions

The Bitcoin halving event is a fundamental part of the cryptocurrency’s design. It controls the creation of new Bitcoin and injects a scarcity factor, similar to mining gold or drilling for oil. The reward for mining a block started at 50 Bitcoins in 2009, and it has halved three times since then. As we look forward to the next halving event in 2024, it’s clear that this mechanism plays a key role in Bitcoin’s value and the operation of its network.

On top of that, it’s worth considering the implications of Bitcoin halving for miners. These events could lead to a shakeup in the mining ecosystem, potentially leading to the exit of individual miners and smaller operations, paving the way for larger players to dominate the scene. As we watch Bitcoin evolve, the halving dances will undoubtedly continue to shape the future of this groundbreaking cryptocurrency.