For companies that maintain a fleet of vans, controlling insurance costs can seem like a constant struggle. But there are ways to trim these costs. And one of the best ways to reduce fleet insurance premiums is improving driving behavior. Promoting safe driving habits can help lower insurance premiums significantly. Also, many companies now check the Motor Vehicle Report when hiring prospective drivers.

Find Available Discounts

Some insurers offer major discounts if you bundle insurance policies with their company. That includes Worker’s Comp, property coverage, general liability insurance, and other policies. By bundling policies together, you may be able to enjoy significant savings.

In addition, there are many discounts available depending on the company you work with. These discounts include savings for GPS trackers installed on fleet vehicles, having a formal maintenance program in place and discounts for paying premiums in advance or converting to paperless billing. These savings can add up quickly.

Use Available Technology

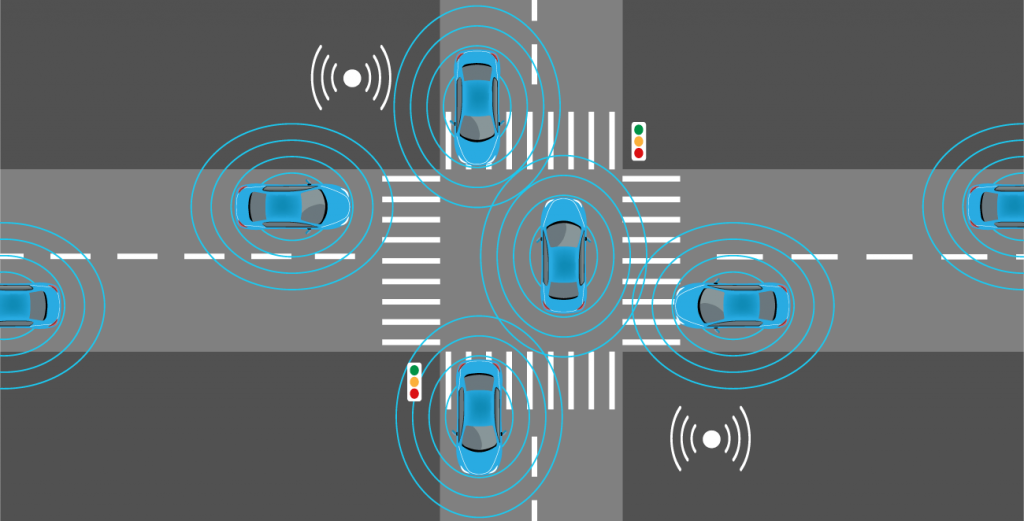

There are many new devices and technologies like GPS vehicle tracking available to help reduce accident rates, which in turn will help to reduce your overall fleet insurance costs. These include in-vehicle telematics and dashboard cameras that demonstrate how vehicles are being driven – whether the driver tends to speed regularly or continually brakes suddenly. They cannot only help to establish fault in case of an accident, but they can also provide a good indication of the driving habits of the vehicle’s driver.

Telematics can also be used to communicate with drivers and send out directions on a hands-free basis, which means the driver can pay attention to the road and driving instead of looking at a screen for driving directions. Some companies even use telematics to send information directly to their insurance company, highlighting driving habits and speed. This is a good way to get drivers to comply with company policies about observing speed limits and traffic laws.

Compare, Compare, Compare!

When a policy is up for renewal, compare the premiums with other insurance companies. Even if you intend to stay with the same insurance company, having comparatives showing lower premiums can provide leverage for a reduction in premiums.

Finally, always get quotes from an independent agent who represents multiple insurers. This way you’re assured that you’re getting independent quotes that don’t favor one company over another. It’s the most accurate way of comparing fleet insurance premiums between insurers. And it never hurts to ask your agent for discounts whenever you add another service van to your fleet.