From millions to metaphorical rags and to millions or billions again, several of the ultra-wealthy have fallen off the list of the United States wealthiest over the years because of financial setbacks. However, they have managed to claw back into the seven-to-ten-figure fortunes.

Some billionaires like Steve Jobs and W. Herbert Hunt did not fall off the long list of the world’s wealthiest individuals, but they suffered big blows during the beginning of their careers.

They also executed outstanding turnarounds that helped them dominate higher billionaire ranks. This is a bold statement to business tycoons who dogged persistence during the beginning of their careers. Here are the five comebacks of 40 & under in the United States.

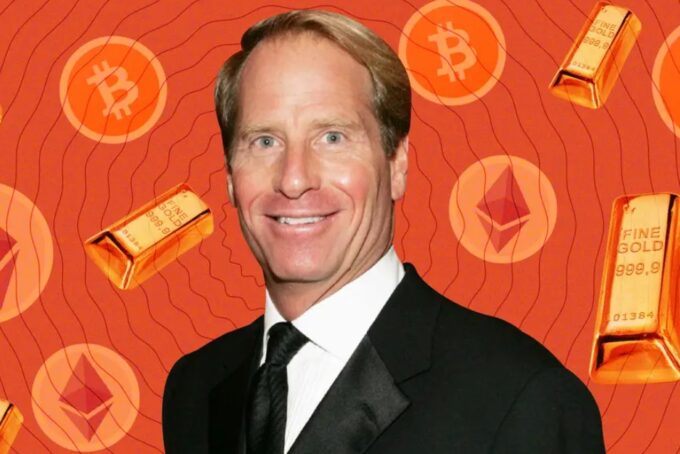

1. Kent Swig

Kent Swig, a New York City-based real estate mogul knows what’s like to endure rough patches in the business world and come out fine at the other end. The Terra Holdings founder has experienced one of the steepest climbs and most challenging fall during the downturn ten years ago but says business is still good.

Swig, 60, is a grandson of the legendary Benjamin Swig, who started building a real estate empire during the Great Depression. He owns and leads several real estate businesses that handle nearly everything from property construction to property management, and owns multi-million-dollar properties across the United States.

Recently, Kent Swig secured $6 billion in gold reserves to support a cryptocurrency empire, DIGau, he has been building. In a recent interview, Swig disclosed that it took 18 months of global hunting for gold assets to secure the multi-billion-dollar gold reserves, adding that Dignity Gold has established a forward purchase agreement for gold from mines located in Lincoln County, Nevada, Mohave County, and Arizona.

DIGau will be a United States-based and gold-backed crypto security that is expected to pay dividends to token-holders. These tokens will be issued according to the set regulatory laws of the regulatory authorities like the Financial Industry Regulatory Authority. You can learn more about Kent Swing here.

2. James Altucher

James Altucher founded Reset Inc., a web design company, during the dot-com boom of the late 1960s. He later sold the company for $10 million and then lost nearly everything in a series of poor investment choices. In an interview, James Altucher said that he made “every poor decision in the book” and when he realized he had only $143 in his bank, he even contemplated suicide.

Altucher eventually came to realize that his business and personal life were in desperate need of evaluation. He stopped judging himself by his net worth, and gradually dug his way out of financial chaos. He started blogging about his reality – riches to rags to riches again life story, which has proven popular.

Also, Altucher began writing books, 20… counting so far, which have been an impressive outlet for his outstanding creativity. Currently, he is a popular podcaster, author, and blogger whose investments are worth millions of dollars.

3. Bill Bartmann

Bill Bartmann is the founder of a debt-collection corporation whose value was estimated to be billions of dollars in the 1990s. His Commercial Financial Services (CFS) based in Oklahoma was the largest debt-collection corporation in the United States.

It enjoyed massive success until Bartmann’s associate got convicted for accounting and financial fraud. Once one of the richest people on the continent, Bartmann was forced to file for bankruptcy. Fortunately, he never let failure block him. Bartmann found financial success again by simply writing about his story of failure.

He has authored famous books such as Bailout Riches and Billionaire Secrets to Success which have become best-sellers. Leveraging his creativity as a stepping stone, Bartmann launched a debt-collection corporation named CFS II, which is currently making $10 million a year.

4. Robert Stiller

Robert Stiller, the founder of Keurig Green Mountain, created his fortune by simply selling the K-cups single-serve coffee pods. Stiller’s endeavors placed him on the list of billionaires in 2011. Unfortunately, he began engaging in poor spending habits and lost a huge portion of his fortune.

By 2012, he had sold shares worth $125.5 million to repay loans taken out against his stock holdings. His company’s stock price plummeted to about $17.11 within less than 12 months after it had been more than $100 per share.

The good news is that Stiller still owned shares worth $8.3 million in his company and improvements in the stock prices since the significant drop in 2012 have helped him recover. Within a short period, Stiller was worth 1.2 billion. He decided to retire in 2013.

5. Maggie Magerko

Maggie Magerko is the daughter of Joe Hardy, the founder of 84 Lumber, a housing supply chain company. She inherited her father’s company in 1992, and by 2006, the corporation was worth $2 billion. However, poor investment choices that began under Hardy’s administration reared their head when the United States housing market started collapsing in 2008, taking the entire construction market down.

Maggie Magerko made the hard choice to put nearly everything she owned, including her personal checking account and expensive jewelry collection, on the line to save 84 Lumber and turn it around. She teetered on the brink of personal and corporate financial ruin. Bur her efforts paid off. Currently, Maggie Magerko is a tough business leader at the helm of a smarter and leaner 84 Lumber. Her net worth is estimated to be $1.3 billion.

Summary

There are numerous reasons entrepreneurs and innovators may lose nearly everything they have been working so hard for. Some of these reasons include poor financial management, personality clashes, bad luck, or poor investment decision making.

Nearly every successful individual out there has experienced a rough patch at some point in their career, but the choices they made determined the magnitude of their comeback or losing everything forever.

The five wealthy individuals discussed above lost nearly everything but they never gave up. They clawed and fought their way back into the light and some of them became stronger than ever.