We all keep our money in the bank account. This is a common place for storing cash you will later spend. Besides, it’s a smart option for saving some funds for an emergency to have quick access to them.

When it comes to the sum you should keep in the checking account, it’s significant that you are strategic and disciplined.

Those who keep a large balance in cash usually miss the chance to grow their wealth and invest their money and even risk losing it due to fraud or identity theft.

It can be helpful to know what other people do with their funds, so keep on reading to find out the average savings account balance in the U.S.

What Is the Average Bank Account Balance?

You can find lots of relevant data about debt, income, and assets in the regular Surveys of Consumer Finances by the Federal Reserve. Many people live from paycheck to paycheck and often turn to lend products for extra assistance.

It’s no surprise that it’s easy to manage one credit account than several. Hence, an online debt consolidation loan may help you turn your multiple loans into a single one with one monthly payment and reduced interest.

Speaking about the median bank account balance for U.S. households is $5,300 while the average bank account balance is $40,000. The average balance is much higher compared to the median.

The median balance is more meaningful for the majority of American consumers, while families with extremely high account balances bring the average higher.

The average account balance includes the response from every household, while those with a major account balance in the middle of the survey answers after the responses were lined from biggest to smallest.

The Average U.S. Savings

The pandemic has shown us the importance of having an emergency fund to protect you from unforeseen curveballs of life. In such difficult times, many people turn to some Payday Say money lending app, which can quickly solve some financial problems, but at the same time reward you with a lot of debt that you have to pay off later. There has been an increasing American wealth gap over the last few years.

Some people face financial disruptions and drained their savings during the pandemic, while others boosted their investments and savings. The rising inflation is one of the top reasons why people tend to save less these days.

A 2024 study from Northwestern Mutual found out that the levels of average savings have lowered by 15% from last year.

The latest data from the Federal Reserve Survey of Consumer Finances states that American households have an average bank account balance of $41,600.

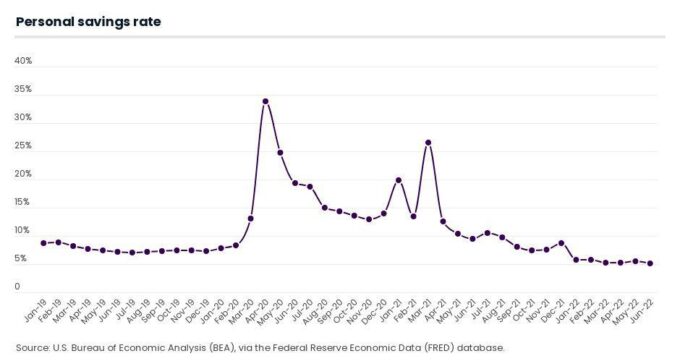

Generally, consumers believe they should have more in their emergency fund than they do as 73% of respondents agree with that. The U.S. personal savings rate lowered from 13.1% in 2020 to 12.6% in 2024.

As we can see from different surveys and polls, many American households aren’t prepared to face monetary issues. Older generations and people who are 65 and older typically have more funds in their savings accounts compared to younger generations.

Besides, if we compare average savings by education and income level, we will notice that people who own a home and have a college degree usually have more funds set aside than people who don’t.

Average Savings by Age

Usually, older people have higher bank account balances than younger people. It can be up to three times as high. The exception is families with members ages 45 to 54 who have higher balances compared to households with individuals ages 55 to 63.

For instance, the median bank account balance for people under 35 is $3,240, while those over 74 have a median balance of $9,300.

Average Savings by Education Level

This is one of the major factors that influence the checking account balance of American consumers. The survey data mentions that the median balance fluctuates along with the education level of people, while consumers with a bachelor’s degree have a median balance of $15,400 and those with only some college have $3,900.

The median balance of people with no high school diploma is just $1,020 so you can see how education is important for smart financial decisions.

Average Savings by Income

Similar to the mentioned levels of education and age difference, age also plays a significant role in the amount you have in your savings.

For example, those who earn less than $20,000 a year have a median bank account balance of $810, while consumers who have an annual income of $60,000 and higher have a median balance of $10,000.

Average Savings by Current Work Status

If we compare the work status of people, those who work full-time or are retired usually have fewer savings than those who are self-employed. Why does it happen? It happens because business owners have additional expenses to tackle along with monetary insecurity. As a result, self-employed workers need to work more and save more.

Generally, the older a person is, the more he or she should consider saving. Older generations usually find it more challenging to secure a new position in case they lose employment.

Those who are preparing to retire should try their best to have enough savings to cover up to 24 months worth of expenses.

Younger generations should save enough to cover three to six months’ worth of expenses. The full-time employee has a median account balance of $5,300 while a self-employed person has about $14,000.

How Much You Should Save

How much should consumers put into their savings accounts? Financial experts recommend workers save 20 percent of their income.

These savings should be spread across accounts like money market accounts, savings accounts, certificates of deposit, and other places where your money can grow and be protected.

Besides, the amount you should save depends on your spending habits. Make a monthly budget to define your regular expenses and understand how much you should allocate toward savings.

The Bottom Line

If you create a budget and take control of spending, you will be able to save more funds and cover unforeseen costs. With the ongoing pandemic and rising inflation rates, you should get the most out of your savings and set a portion of your monthly income aside.