Many businesses today harness the powers of two financial documents (purchase order and invoice) to boost business operations and promote efficiency daily.

You might have also come across online tools like Quikflw that allow you to use all types of such modules under one neat software.

In the eyes of many, these documents seem alike. It is true that they have many similarities, but that doesn’t take away the differences. It is important that we clearly understand these differences since they are important in the transaction process.

When you are not very familiar with some very important business terms it could affect your flow with your customers and also communication with other clients.

Firstly, what are these two documents?

Purchase order

To put it simply, this document is sent from the buyer to the seller or vendor in order to grant a purchase. A purchase order indicates the items the buyer decides to buy and the prices. Sometimes the purchase order may allow a company to order a particular product as many times as possible for a certain period of time.

A purchase invoice is usually issued when a customer wants to buy supplies from the seller. Many purchasing systems exist today which can record what has been ordered, what has arrived and what is not invoiced.

The accuracy of a purchasing order system prevents the situation of ordering what you do not need. Sometimes it helps in accurate matching up of items as regards what is ordered and what should be delivered to prevent wrong delivery of products. Many software is available to aid the sending of purchase orders to sellers or other vendors online is already available templates.

What information is found out of the purchase order?

- The date of the purchase order

- The purchase order number

- List of goods and service requested

- Information about the client

- Information about the supplier

- Terms and conditions

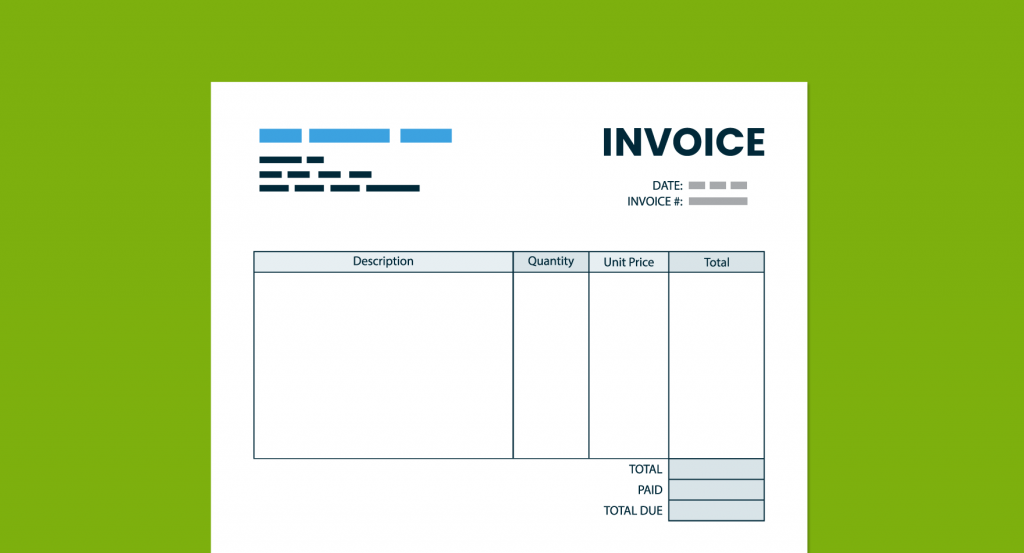

Invoice

Invoice is usually in the form of a slip issued by the seller to the buyer showing items which have been sold, payments, and signatures of buyer and seller. It shows that the buyer has some money to give to the seller after showing the list of products the seller grants to the buyer. Many invoices these days are issued using online software.

Making use of an invoice helps you to track the money you make and your expenses as a seller. It also helps in inventory checking and management and helps you to calculate the profit made. They also serve as a reference for all your business transactions and gives you a measure of control over your business and to monitor your progress.

What information do you find in an invoice? Some of them include:

- The Sellers name and address

- The buyers’ name and address

- Number of the invoice

- Prices of products and discounts

- Date of issuance of the invoice

- Date of payment due

From the descriptions of these two documents, it is clear that they have very unique characteristics and differences between themselves.

A very important difference between these two documents is that a purchase order shows that an order has been placed as regards goods and services and an invoice shows requests as regards the due payments for an order.

Another important difference is that a buyer prepares the purchase order while the seller makes an invoice showing the lists of goods and payments to be received.

The details in both documents are the same except that invoice number, purchases order number, and few other items found on the invoice which is not in the purchases order.

A list showing differences:

-

- Purchases order is prepared by the buyer while the invoice is by the seller

- Purchases order is received by the seller while an invoice is received by the buyer

- Purchases order is sent at the onset of order while the invoice is at after order is complete and payment terms agreed

Benefits of Automation Software for Purchase Orders and Invoices

Small, medium-sized businesses and big companies would benefit from using automation software for purchase orders, invoices, and even other accounting tasks. According to tipalti.com, using automation software can free accounts payable departments up to 80 percent of the workload.

Check out the benefits of AP (accounts payable) automation:

- Scalability

Your business can scale rapidly without needing to hire additional staff. Automation gets the repetitive tasks that were done manually in the past.

- Automated Invoicing

With AP software, invoices are processed automatically, eliminating errors with machine learning and advanced OCR technology.

- Accelerate Finances

You can accelerate your financial using AP software by integrating detailed transactions and reconciliation reports with enterprise resource planning (ERP) system.

- Eliminate Compliance and Financial Risks

A reliable AP software eliminates the risks in your finances and enables full compliance with tax and employment laws because of W-9 and W-8 tax compliance, approval workflows, and audit trails. You can develop purchase order processes tailor-fit to the approval workflow of your accounts payables team.

- Integration

With AP software, combined with ERP software, managers and other users can use the helpful features and real-time data or metrics it provides to create accurate and effective business forecasts. This is because the ERP software data is complete and accurate, leaving no room for errors, unlike manual and traditional methods.

- Proper Collaboration

A business needs proper collaboration among the management, workers, and other important people that make up the business.

- Preventing Financial Fraud

Financial fraud, particularly in accounts payable (AP) processes, is a growing concern for businesses of all sizes. Manual AP workflows leave room for fraudulent activities such as fake vendors, false billing, and fraudulent checks. These fraudulent payments occur due to errors in data entry, lack of verification, or inadequate payment controls. However, implementing accounts payable workflow automation can significantly reduce the risk of fraud by incorporating the following features:

Two-Way, Three-Way, or Four-Way Matching: Automation tools utilize optical character recognition (OCR) technology to match purchase orders and sales receipts with invoices. By verifying these documents, discrepancies and fraudulent invoices can be detected, preventing unauthorized payments.

Automated Invoice Approvals: Manual approval processes are prone to errors and delays. With automation, invoices can be routed to the appropriate stakeholders based on predefined rules and workflows. This ensures timely approvals and reduces the risk of fraudulent payments slipping through the cracks. Visit Coupa to learn more about e-invoicing and many other automated solutions.

Audit Trail and Transparency: An automated AP system maintains a comprehensive audit trail, allowing the accounting team and auditors to track every step of the process. This transparency enhances accountability and provides a robust mechanism for detecting and investigating fraudulent activities.

- Avoiding Overpayment

In a manual AP workflow, errors in checking for duplicate invoices, data entry, vendor verification, and supplier changes are common. These mistakes can result in overpayments, negatively impacting cash flow and overall financial health. However, accounts payable workflow automation offers a centralized and automated system that minimizes errors and ensures accurate payment processing. By eliminating these errors, organizations can avoid overpayments and maintain the necessary cash flow for their day-to-day operations.

- Improved Audit Processes

Manual AP workflows often lead to time-consuming audits, with the accounting team sifting through endless paperwork. However, implementing an automated AP system organizes and stores all the necessary data in one place, making audits more efficient and time-saving. The system captures and retains digital records of invoices, approvals, and payment transactions, simplifying the audit process and providing auditors with easy access to required information.

- Timely Payments

In a traditional AP workflow, human errors and delays can result in missed or late payments, leading to penalties and strained vendor relationships. By transitioning to an automated process, organizations can minimize mistakes and ensure timely payments. The centralized system enables efficient invoice matching, verification, and approval before initiating payments. With automated reminders and workflows, organizations can avoid missed payment deadlines, maintain positive vendor relationships, and protect their profitability.

An AP and ERP software provides consistent and centralized data entered into the system. They provide a continuously updated view and integrated core business processes. This involves using common databases that are maintained by a secure and reliable database management system, which promotes effective and straightforward collaboration.

These differences highlight the importance of these two documents in business transactions. It is important to note that a good understanding of documents used in business transactions, is beneficial and a plus to ensure the smooth running of the business.